At the Crossroads of Trade, Technology, and Wealth: Why Fractalized is the Future of Investment

2024-10-05

6 min read

#Shipping

#Investment

The world is undergoing transformative shifts across trade, technology, and wealth, reshaping economies, industries, and individual opportunities. Amid these changes, Fractalized was born with a mission to democratize access to elite investment vehicles, starting with the vast maritime shipping industry. By focusing on high-yield, under-accessible markets, we aim to address critical global challenges and unlock opportunities for investors worldwide.

Global Macro Shifts Driving Demand for Fractalized

Trade: An Expanding Global Network

Global trade continues to evolve, fueled by new free trade agreements like the Regional Comprehensive Economic Partnership (RCEP), connecting major economies such as China, Japan, South Korea, and Australia. Complementing longstanding agreements like NAFTA and AFTA, these frameworks are paving the way for more robust international trade.

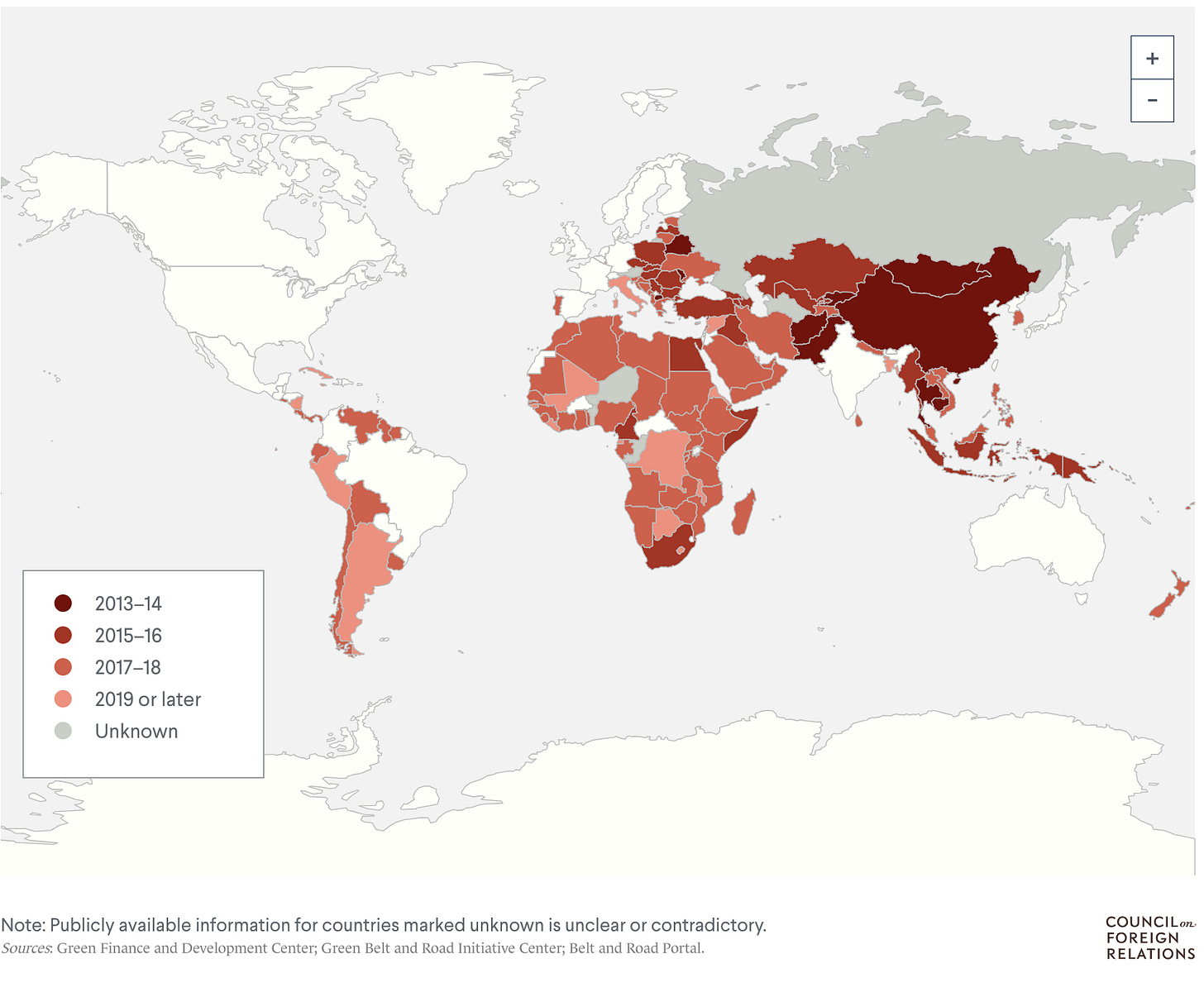

China's ambitious Belt and Road Initiative (BRI) further underscores this trend, integrating over 100 countries into its global trade network. Simultaneously, significant port investments by global operators and private equity firms signal the surging importance of maritime trade.

Major investments into ports globally include:

- Large port operators like PSA International, APM Terminals, DP World, and Hutchison Port Holdings, have invested in multiple port projects worldwide.

- PSA International, for example, participates in 28 port projects through 16 countries, handling a global capacity of over 100 million twenty-foot equivalent units (TEU) per year.

- Private equity firms and investment groups, such as GLP, focus on logistics real estate in regions like Vietnam and Japan.

- State-owned enterprises from China, which control or have major investments in more than 100 ports globally, enhance China's access to worldwide markets.

With maritime shipping accounting for 90% of global trade, these developments position the industry as a critical pillar of global commerce—and a lucrative investment avenue.

Technology: Driving Innovation in Investment and Shipping

Technological advancements are revolutionizing industries, and shipping is no exception. Innovations in materials, AI, and sensor technology have made cargo shipping more efficient, cost-effective, and reliable, enhancing its competitiveness over air and land freight.

Simultaneously, blockchain technology has unlocked new possibilities:

- Fractional ownership: Tokenization allows investors to buy shares in assets like ships, making traditionally inaccessible opportunities available to a broader audience.

- Automated dividends: Blockchain-powered systems simplify distributing earnings to large pools of investors.

Moreover, the exponential growth of global e-commerce—projected to surpass $8 trillion by 2027—continues to boost demand for international shipping solutions. Fractalized operates at the intersection of these technological advancements, combining efficiency, accessibility, and innovation.

Wealth: Inequality and the Need for Democratized Investment

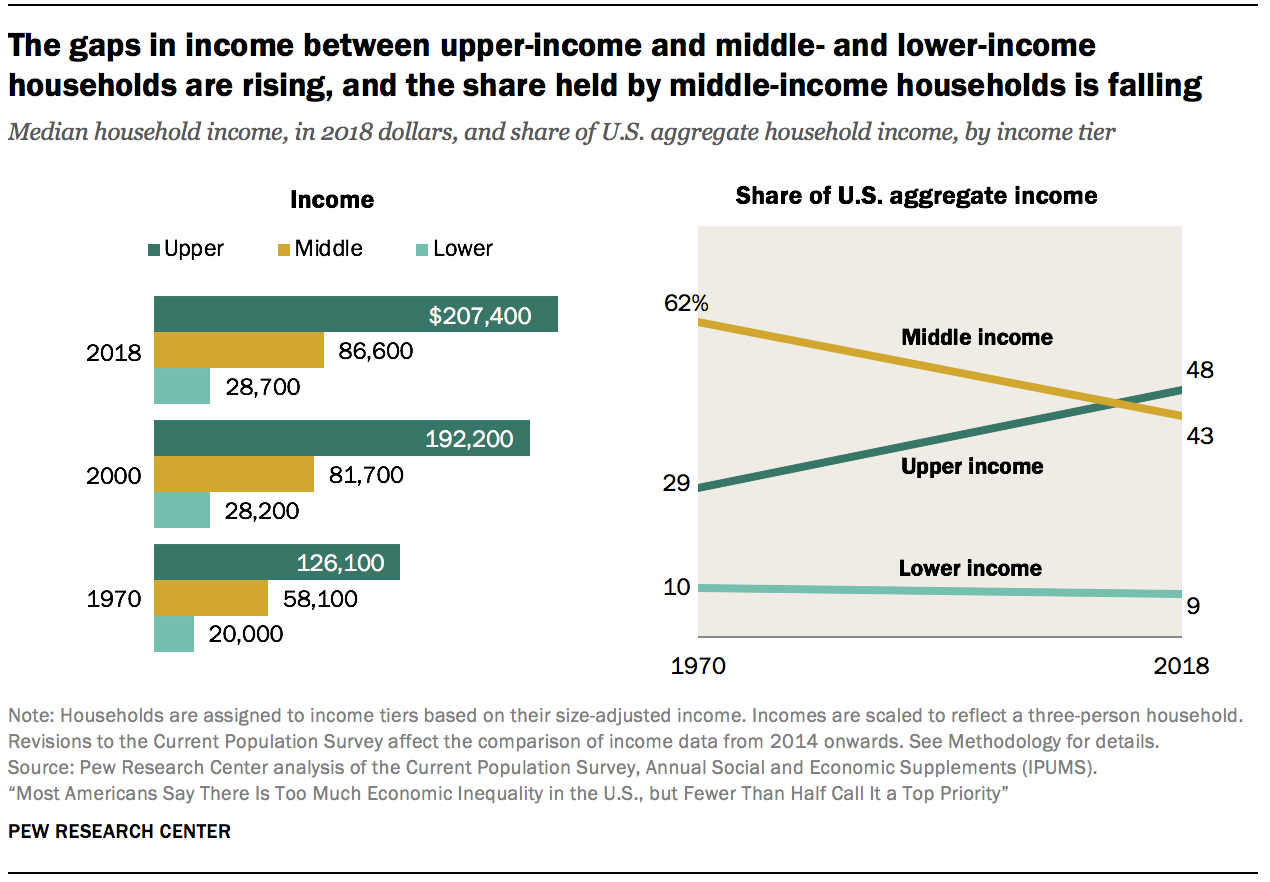

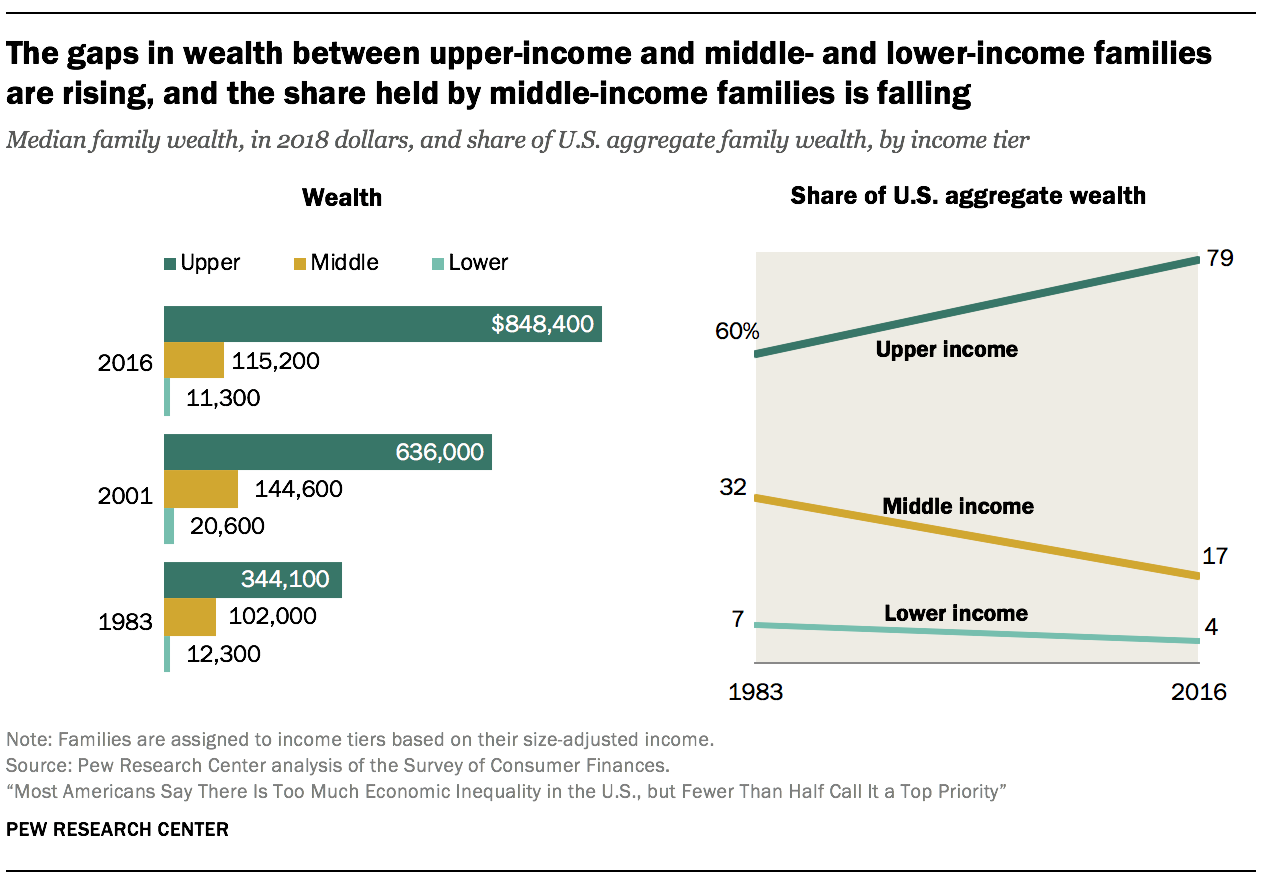

While global wealth is rising—expected to reach $629 trillion by 2027—the wealth gap is widening. The richest 10% control over 50% of income, while the bottom half of the population shares only 8%. This disparity highlights the inaccessibility of elite investment vehicles, which are often restricted to institutional investors or individuals with millions in net worth. The main divergence in inequality is in the wealth gap, though the income gap is also widening (at a linear pace) the real chasm lies in wealth (compounding difference).

Emerging markets face significant hurdles. While nations like Turkey, Nigeria, and Pakistan show growing investable wealth, their economic and political instability pushes individuals toward alternative investments. The surge in cryptocurrency adoption—both in these regions and in established economies like China and the USA—reveals deepening skepticism toward traditional financial systems and a strong demand for accessible, secure alternatives.

Fractalized aims to address these inequalities by breaking down barriers to high-yield investment opportunities. Through fractional ownership, we empower investors from diverse financial backgrounds to participate in wealth-building markets.

Initial Focus: The Maritime Industry

Our strategy is centered on an asset class with:

- A straightforward regulatory framework: Simplifying the navigation of legal landscapes.

- High yield potential: Offering substantial returns to investors.

- A massive addressable market: Ensuring scalability and growth.

This led us to the maritime shipping industry—a $2.2 trillion market where vessels historically yield an average ROI of 14%. Moreover, maritime assets operate in international waters, simplifying jurisdictional complexities. These features make maritime shipping the perfect starting point for our mission.

A Giant Addressable Market

Maritime shipping is the backbone of global trade, responsible for transporting 90% of all goods worldwide. Valued at $2.2 trillion in 2021 and projected to grow to $4.2 trillion by 2030, the maritime shipping industry offers an immense and expanding market. As global commerce continues to grow—fueled by trade agreements, e-commerce, and technological advancements—the demand for shipping services will rise in tandem, creating a strong growth trajectory for this sector.

High-Yield Potential

Maritime shipping has historically offered strong financial returns. Commercial vessels typically generate a 14% ROI for their owners, outperforming many traditional investment vehicles. These predictable, high yields are driven by the steady demand for shipping services, long-term charter contracts, and efficient vessel operations.

By tokenizing maritime assets, Fractalized makes these attractive returns accessible to a much wider audience, enabling individuals and smaller institutional investors to benefit from what was once the domain of the ultra-wealthy.

Why Tokenization Works for Shipping

Shipping assets, like commercial vessels, are inherently well-suited for tokenization. Each vessel operates as a self-contained revenue-generating entity, making it easy to isolate and fractionalize ownership. Through tokenization, Fractalized divides vessel ownership into small, affordable units, allowing investors to own a piece of these lucrative assets for a fraction of the cost.

This approach not only democratizes access to an exclusive market but also introduces liquidity to an asset class that has traditionally been illiquid, allowing investors to buy, sell, or trade their stakes on our platform.

A Platform Built for the Future

Fractalized brings together the transformative trends in trade, technology, and wealth to create an investment platform tailored for today's global challenges:

- Democratizing Access: By tokenizing maritime assets, we make high-value investments affordable and accessible to individuals worldwide.

- High-Yield Opportunities: With an average ROI of 14%, our platform provides attractive alternatives to traditional investment vehicles.

- Geopolitical Resilience: Our model offers stability in regions grappling with economic uncertainty, giving investors a safe harbor amidst volatility.

In Conclusion: A New Era of Investment

The convergence of global macro trends highlights a pressing need for innovation in how we invest and build wealth. At Fractalized, we see this as an opportunity to empower millions, disrupt legacy industries, and redefine access to elite markets.

Our mission isn't just about financial returns—it's about leveling the playing field and creating a more inclusive financial future. With Fractalized, we're not just investing in ships; we're charting a new course for the world of investment.

Fractalized Blog & Industry News

Stay updated with the latest insights on maritime investments, blockchain innovation, and real-world asset (RWA) tokenization.

We would love

to hear from you.

Feel free to reach our if you want to collaborate with us, or simply have a chat

Contact

Our Email

Fractalized Tokenization Labs Ltd.

Unit IH-00-01-02-OF-01, Level 2 Innovation Hub Dubai International Financial Center Dubai

Follow us