Chemical Tankers: The Next Big Tokenized Asset for Stable, High-Yield Returns

2024-12-10

6 min read

#Shipping

#Investment

Introduction: A Market on the Rise

The maritime industry has long been a cornerstone of global trade, facilitating the movement of goods, commodities, and raw materials across continents. While much attention is given to dry bulk and container shipping, the chemical tanker market stands out as a sector with less volatility, stable demand, and high-return potential.

As the tokenization of real-world assets (RWA) gains traction, investors are looking for stable, revenue-generating assets to add to their portfolios. Chemical tankers, with their predictable income streams and historically lower volatility , present a prime opportunity for fractionalized investment.

This article will explore the future outlook of the chemical tanker market , compare its volatility against other shipping verticals , and explain why it is the ideal asset for tokenization , offering consistent yields in a rapidly evolving investment landscape.

The Chemical Tanker Market: Growth, Trends, and Stability

Projected Market Growth

The chemical tanker market is expected to grow steadily over the next decade , driven by increasing chemical production, rising global trade, and the expansion of end-use industries such as pharmaceuticals, agriculture, and consumer goods.

Recent forecasts indicate:

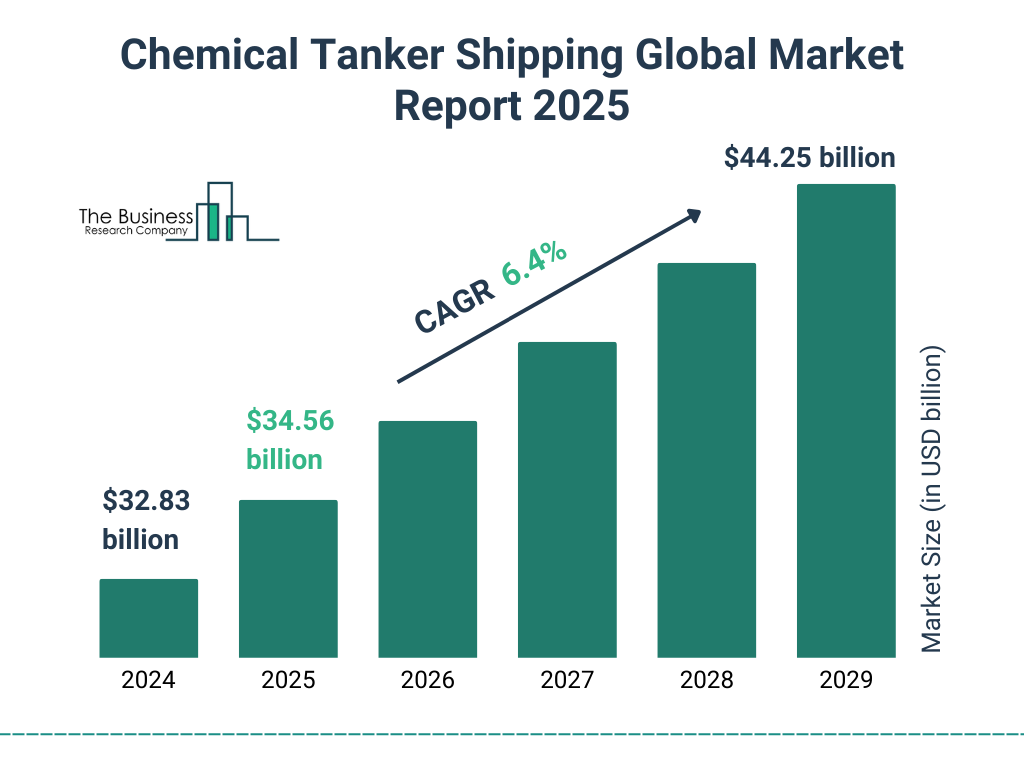

- The market will grow from $32.83 billion in 2024 to $34.56 billion in 2025 at a CAGR of 5.3% 【source: The Business Research Company】.

- By 2034, the market is projected to surpass $54.7 billion , reflecting sustained demand【source: Precedence Research】.

Unlike dry bulk or container shipping , which is highly cyclical and reactive to macroeconomic conditions , chemical tankers benefit from stable, non-discretionary demand , making them a safer investment option.

Why Chemical Tankers Are Less Volatile Than Other Shipping Markets

Whilst for older dry bulk, container vessels and larger crude/product tankers, spot or short term employment appears to be the only viable options especially in weaker markets, chemical tankers of any vintage enjoy the possibility of longer term, multi-year, stable time charter contracts.

1. Essential Cargo and Consistent Demand

Chemical tankers transport specialized liquid chemicals , many of which are critical to industrial processes. Unlike commodities such as iron ore or coal (which fluctuate with construction and energy cycles), the demand for chemicals remains relatively stable and recession-resistant.

-

Pharmaceuticals, agriculture, and industrial manufacturing rely on chemical transport regardless of economic conditions.

-

Contracts for shipping chemicals are often long-term, reducing exposure to spot market volatility.

2. Advantageous Orderbook Outlook (Newbuilding order book vs existing fleet)

Our research on the order books of leading shipyards around the world indicates a surge of newbuilding orders placed for larger tankers in the last couple of years. However chemical tankers have more or not had a healthy ordering thus global fleet profile and overall this market vertical’s outlook looks healthier. Our internal study demonstrates that new builds only constitute around 7% of the chemical tanker market for smaller size chemical tankers.

Order books are a critical signal in understanding where the market is going, as they provide us the insight on supply. Similarly trade volumes provide the necessary insight to understand future demand.

3. Long-Term Contracts Provide Stability

Unlike container or dry bulk shipping, which often operate on short-term spot markets , chemical tankers favor long-term contracts with chemical manufacturers. These agreements ensure predictable revenue streams , mitigating the extreme volatility seen in other shipping sectors.

4. Regulatory Compliance Creates a High Barrier to Entry

The chemical shipping industry requires specialized vessels with strict compliance to safety and environmental regulations. The complexity and high cost of operating these ships limit market entrants , reducing overcapacity risks.

5. Market Fluctuations in Larger Chemical Tankers

For older dry bulk and container vessels, as well as larger crude and product tankers, spot or short-term employment seems to be the only viable option. Whereas chemical tanker rates remain more stable , providing a low-correlation asset class that buffers investors from broader shipping market fluctuations.

The Perfect Asset for Tokenization

1. Chemical Tankers Offer Stable, High-Yield Investments

Historically, the average return on investment (ROI) for chemical tankers has been approximately 14% per year , making them one of the most lucrative maritime assets. Unlike traditional equities, which fluctuate with market sentiment , these assets provide predictable revenue streams due to long-term contracts.

2. Tokenization Provides Accessibility to a Previously Exclusive Market

The maritime investment sector has traditionally been restricted to institutional players and high-net-worth individuals. Tokenization removes this barrier , allowing fractionalized ownership of high-yielding chemical tankers.

By purchasing tokenized shares of a chemical tanker , investors gain:

-

Passive income through dividend distributions from vessel earnings.

-

Liquidity via secondary markets , offering greater flexibility than traditional shipping investments.

-

Real-world asset backing , ensuring investments are tied to physical revenue-generating assets.

3. Blockchain-Based Transparency and Security

Tokenized investments provide unprecedented transparency , with blockchain technology ensuring verifiable ownership, secure transactions, and automated revenue distribution.

Unlike investing in publicly traded shipping companies (where market speculation influences stock prices), tokenization directly links investment performance to real-world maritime operations.

Strategic Outlook for Investors: Why Now Is the Time to Act

With stringent IMO 2030 and IMO 2050 environmental regulations , chemical tanker operators are modernizing their fleets to meet new efficiency and emissions standards. This transition creates significant investment opportunities as older vessels are upgraded to become future proof.

That being said, although the maritime sector has also set decarbonization targets, it still remains unclear as to what will be the propulsion thus fuel systems of the future. Very select players on very large crude carriers have opted for dual propulsion options such as LNG dual-fuel, still the majority of market players remain on the safe side ordering vessels with conventional fuel types whilst waiting for future technologies to evolve (ammonia, hydrogen etc.)

For investors, now is the perfect time to enter the market through tokenized ownership:

-

Rising Chemical Demand Will Sustain Long-Term Growth – Industrialization and urbanization in emerging markets will continue fueling demand for chemical shipping.

-

Tokenized Maritime Assets Will Become More Mainstream – As blockchain-based RWAs gain acceptance, early adopters stand to benefit the most.

Conclusion: A New Era of Stable, High-Yield Maritime Investing

The chemical tanker market is uniquely positioned as a stable, high-yield asset class , making it an ideal candidate for tokenization. Unlike other maritime sectors, it offers:

-

Lower volatility

-

Strong long-term contracts

-

Consistent demand from industrial sectors

-

High barriers to entry that protect against market saturation

With tokenization, investors now have access to a once-exclusive market , allowing them to own a share of a revenue-generating chemical tanker while benefiting from passive income, real asset backing, and liquid secondary markets.

🚢 Ready to invest in the future of maritime tokenization?

Whether you're an institutional investor, a crypto-native looking to diversify into real-world assets, or a maritime industry veteran , the chemical tanker market offers a uniquely secure and profitable investment opportunity.

Join the tokenization revolution today and secure your stake in one of the most resilient sectors in global trade. 🚀

Fractalized Blog & Industry News

Stay updated with the latest insights on maritime investments, blockchain innovation, and real-world asset (RWA) tokenization.

We would love

to hear from you.

Feel free to reach our if you want to collaborate with us, or simply have a chat

Contact

Our Email

Fractalized Tokenization Labs Ltd.

Unit IH-00-01-02-OF-01, Level 2 Innovation Hub Dubai International Financial Center Dubai

Follow us