The Intersection of Tradition and Innovation

2024-12-10

6 min read

#Shipping

#Investment

The Intersection of Tradition and Innovation

The Intersection of Tradition and Innovation

Fractalized aims to democratize access to high-yield investment opportunities, and the commercial shipping industry presents a compelling case for fractional investing. This decision is anchored in the market’s vast size, steady profitability, high barriers to entry, and the compatibility of its assets with fractional ownership models.

Macro Analysis of the Shipping Market

Market Size and Growth Trajectory

The global maritime shipping industry was valued at $2.2 trillion in 2021 and is projected to grow to $4.2 trillion by 2030, with a compound annual growth rate (CAGR) of 7%. This growth is driven by:

-

Global Trade Dependency : Shipping handles 90% of global trade, making it the backbone of international commerce. This reliance ensures a consistent demand for maritime services.

-

E-Commerce Boom : With global e-commerce sales forecast to reach $8 trillion by 2027, the demand for freight forwarding and shipping solutions continues to escalate.

-

Technological Innovations : Advancements in vessel design, navigation systems, and efficiency-enhancing technologies are reducing costs and environmental impact, making shipping more attractive to investors.

-

Emerging Market Contributions : The rise of trade agreements like RCEP and infrastructure initiatives such as China’s Belt and Road have further cemented shipping’s critical role in global commerce.

Cyclicality and Returns

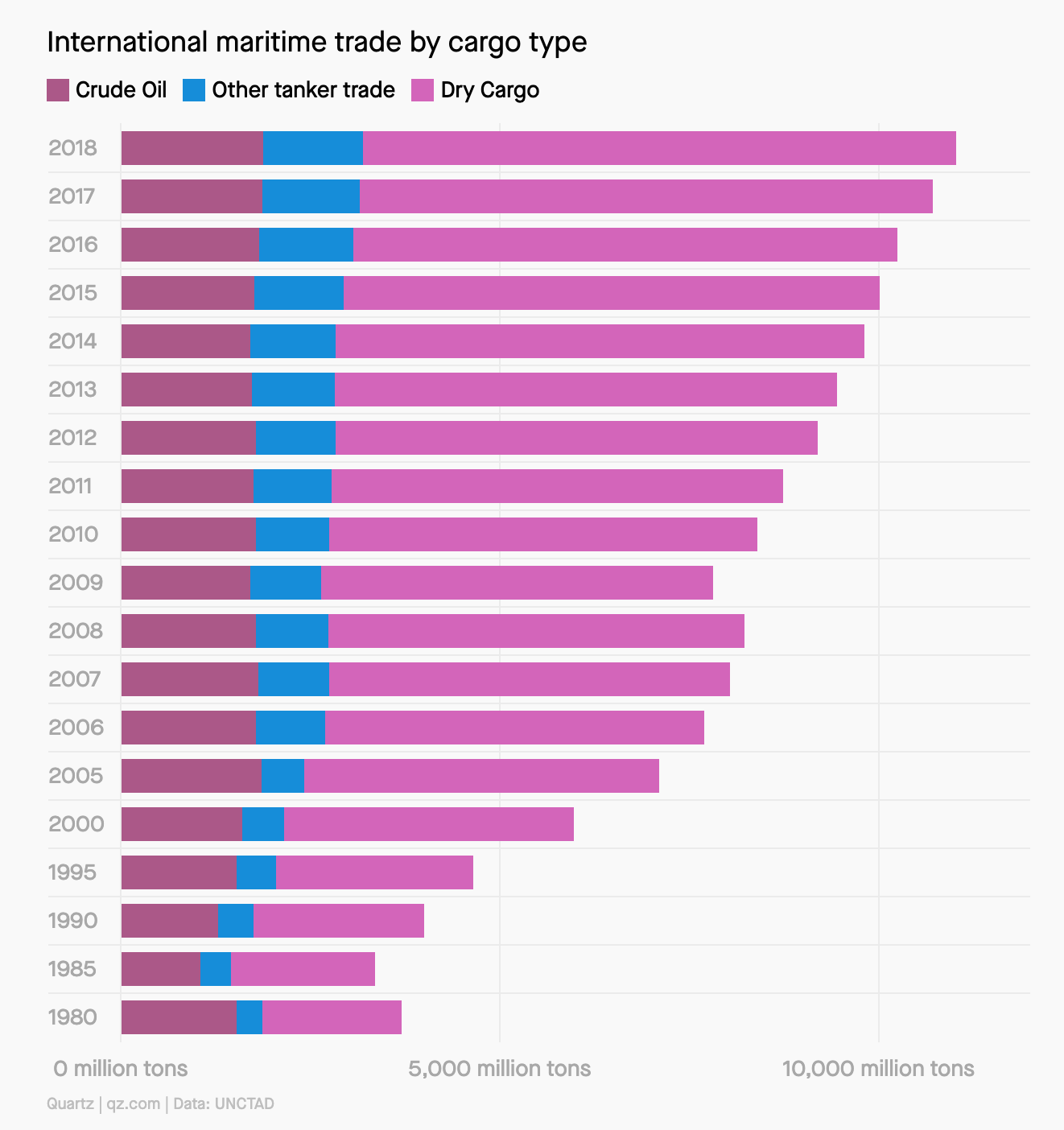

The shipping market’s cyclicality, with approximately 7-year market cycles, presents opportunities for high returns when investments are well-timed. Properly managed maritime assets typically yield 14% ROI annually. Dry bulk dominates the trade, but liquid cargo (e.g., oil and chemicals) offers even higher profitability due to specialized handling.

Challenges and Expertise

Despite its lucrative potential, the sector’s complexity, involving regulatory frameworks and operational nuances, has traditionally limited participation to institutional investors. Fractalized leverages expertise from leading maritime professionals to mitigate these barriers.

Why Shipping Is Ideal for Tokenization

1. High Barriers to Entry

- Ships require significant capital investment, traditionally restricting ownership to large institutions. Tokenization fractionalizes this ownership, enabling participation from smaller investors.

2. Large and Addressable Market

- With its trillion-dollar valuation and essential role in trade, the shipping market offers both scale and long-term growth potential. Fractionalizing these assets expands access to a previously exclusive market.

3. Steady Revenue Streams

- Ships generate reliable income through time-charter contracts. These predictable cash flows make them ideal for tokenized investment models.

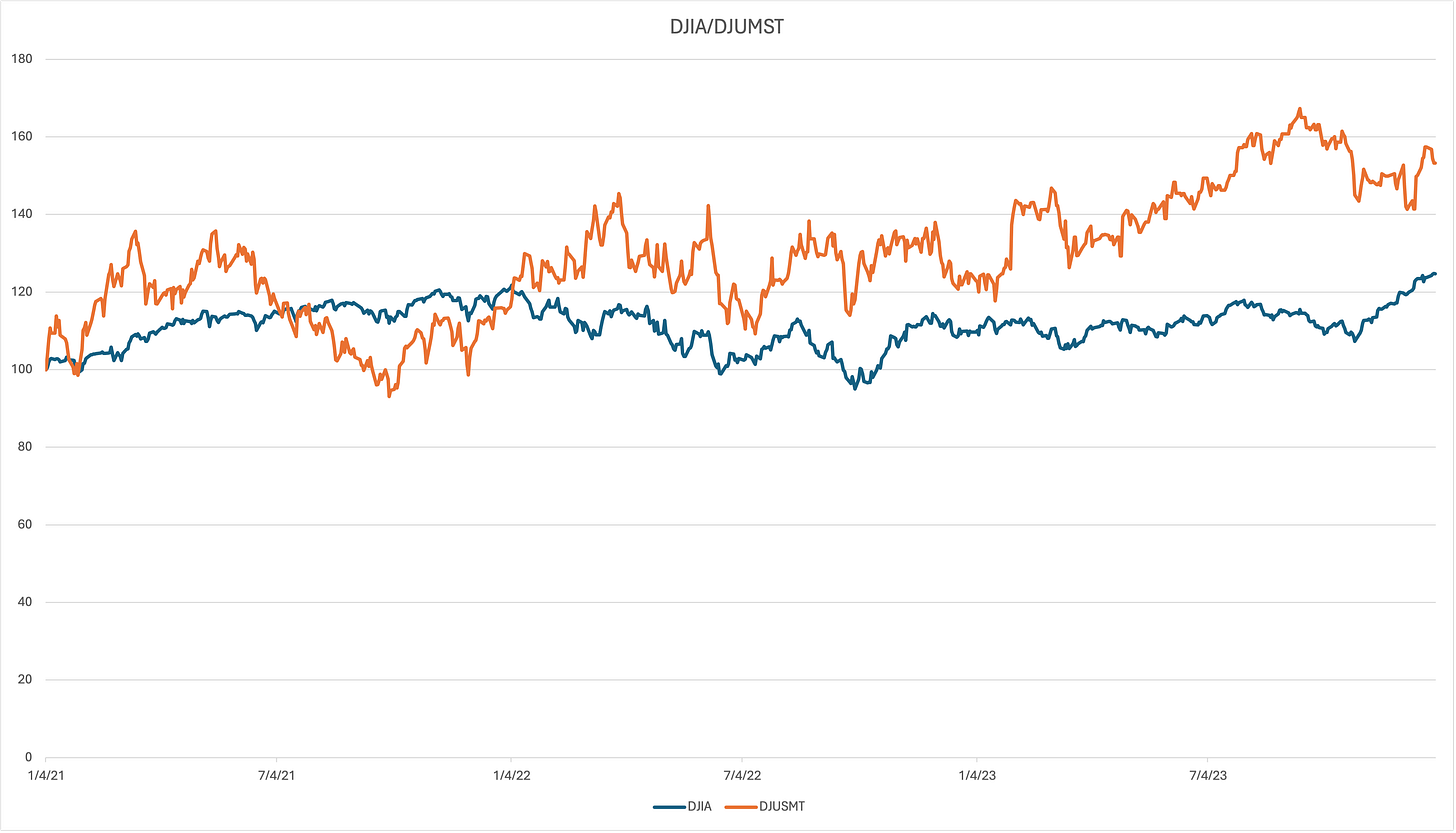

4. Low Correlation with Traditional Markets

-

The maritime industry exhibits minimal correlation with equity markets, providing diversification for investors.

-

A quick study comparing the Dow Jones Industrial Average to the Dow Jones Marine Transportation Index reveals a correlation of 0.1399. This low correlation makes commercial marine vessels a great investment asset.

5. Compatibility with Blockchain

- Blockchain’s transparency and efficiency enhance the shipping industry’s traditional investment mechanisms. Tokenization simplifies asset management, dividend distribution, and secondary market liquidity.

Strategic Alignment with Fractalized’s Mission

Fractalized’s mission is to provide accessible, secure, and high-yield investment opportunities. Shipping aligns perfectly with this mission for the following reasons:

-

Accessibility : By lowering the financial barriers to ship ownership, Fractalized empowers retail investors to partake in an asset class previously limited to the wealthy.

-

Transparency : Blockchain ensures transparency, with every transaction recorded on a decentralized ledger.

-

Global Vision : The international nature of shipping matches Fractalized’s global outlook, catering to investors across diverse markets.

-

Sustainability and Innovation : Tokenization supports greener operations by facilitating funds for eco-friendly ship upgrades and compliance with ESG standards.

Leveraging Fractalized’s Expertise to Succeed

Fractalized’s entry into the maritime shipping industry is powered by its exceptional management team and advisory board, which bring together decades of global expertise in shipping, finance, and blockchain technology. This diversity of experience positions Fractalized as uniquely capable of navigating the complexities of the shipping market and unlocking its potential for tokenization.

A Global Perspective on Shipping Expertise

Fractalized’s team is strategically diverse, with experience spanning key maritime regions:

-

Europe : Expertise in regulatory compliance and investment frameworks across the European Union and the UK.

-

Asia : Insights into high-growth Asian trade routes and logistics hubs, ensuring access to rapidly expanding markets.

-

Middle East : Strong connections to energy shipping markets, offering deep knowledge of this strategically vital region.

Specialized Leadership Across Key Domains

-

Shipping Operations and Asset Management Fractalized’s maritime experts bring decades of experience in vessel selection, operations, and market cycles. They ensure that every asset is optimized for profitability and efficiency.

-

Financial and Legal Expertise The team includes financial strategists with a deep understanding of global investment frameworks with decades of experience and legal specialists who navigate regulatory compliance. This combination ensures investor confidence and operational integrity.

-

Blockchain and Technology Innovation By integrating blockchain technology with traditional asset management, Fractalized creates a seamless platform for investors, offering transparency and liquidity in a historically illiquid market.

Industry Alliances and Risk Management

Fractalized will collaborate with established industry players like VesselValue, which provides real-time valuation and analytics for maritime assets. Additionally, robust risk management frameworks oversee insurance, compliance, and operational costs, ensuring stability and predictability for investors.

Commitment to Risk Management and Operational Excellence

The team's depth ensures robust risk management practices:

-

Marine Asset Risk Management : Experts oversee insurance, compliance, and operational risks, providing stability and predictability for investors.

-

Adaptive Market Strategies : By leveraging insights from cyclical market patterns, and using the collective expertise of its seasoned advisory board, Fractalized optimizes asset acquisition and sales, ensuring returns even in fluctuating conditions.

Conclusion

By focusing on the shipping industry, Fractalized bridges the gap between a traditional yet profitable market and the democratizing power of blockchain. This alignment not only unlocks new investment opportunities for a global audience but also sets a precedent for transforming other high-value, illiquid asset classes. As the shipping market continues to grow, Fractalized’s innovative approach positions it as a leader in democtatizing access to wealth building opportunities. Its leadership’s comprehensive expertise ensures not only operational excellence but also the ability to innovate and adapt within a complex global market.

Fractalized Blog & Industry News

Stay updated with the latest insights on maritime investments, blockchain innovation, and real-world asset (RWA) tokenization.

We would love

to hear from you.

Feel free to reach our if you want to collaborate with us, or simply have a chat

Contact

Our Email

Fractalized Tokenization Labs Ltd.

Unit IH-00-01-02-OF-01, Level 2 Innovation Hub Dubai International Financial Center Dubai

Follow us